Subscription Economy to Be Worth Almost $1 Trillion by 2028

A new study by Juniper Research found that by 2028, subscription economy revenue will reach $996 billion, up from $593 billion in 2024; a substantial rise of 68%.

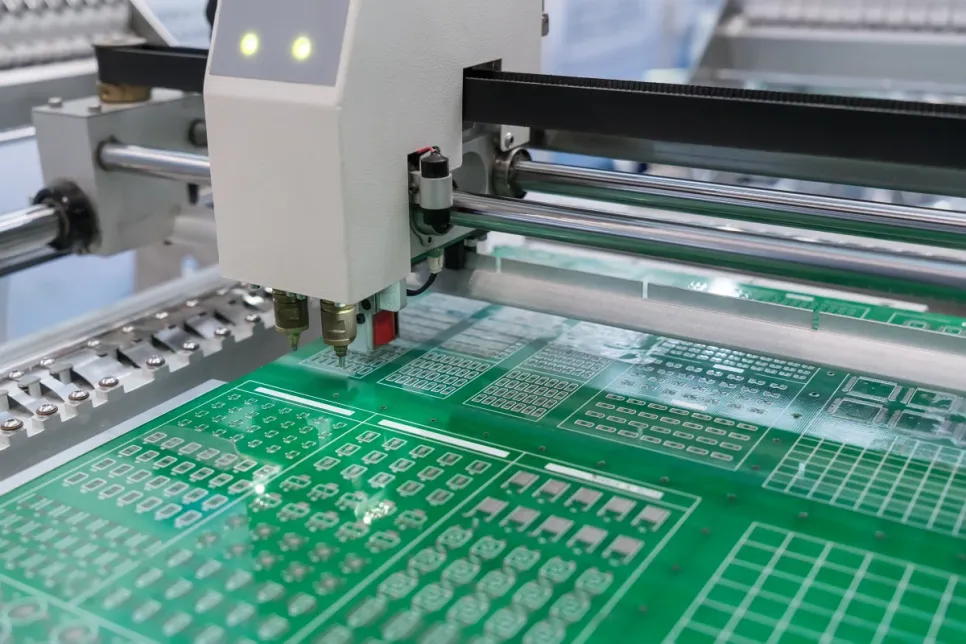

Omdia’s latest Competitive Landscape Tool report reveals a downturn in the semiconductor industry, with revenue down 9% from $597.7 billion in 2022 to $544.8 billion in 2023. This decline follows two years of record growth, highlighting the cyclical nature of the semiconductor market.

“The extended upswing that commenced during the COVID era has concluded. Following a surge in semiconductor demand during the pandemic, leading to a market shortage, the situation has reversed. Demand has softened due to macroeconomic factors, while semiconductor component supply has increased,” said Cliff Leimbach, Senior Research Analyst at Omdia.

In 2023, despite the overall downturn in the semiconductor industry, AI emerged as a significant growth driver in the industry with companies focused on this segment reaping its benefits. NVIDIA has been the clear winner in this space, more than doubling its semiconductor revenue to $49 billion in 2023. This achievement is underscored by NVIDIA’s trajectory, as its semiconductor revenue was under $10 billion before the pandemic in 2019. Although the largest benefactor of AI, it’s important to note that NVIDIA is not the only player capitalizing on this trend.

High bandwidth memory (HBM) integrated with GPUs to facilitate AI is also seeing strong demand, with SK Hynix leading this segment and other major memory manufacturers venturing into this space. The memory market had a down year in 2023 overall, while the HBM market exhibited strong growth of 127% year-over-year in terms of 1Gb equivalent units, throughout 2023. Omdia forecasts that HBM is likely to record higher unit growth rates in 2024, ranging between 150-200%, and is expected to lead memory market growth.

In 2023, the automotive segment exerted greater influence in the semiconductor market as it increased its revenue growth to over 15% in 2023 to over $75 billion. The increase in electric vehicles and integration of intelligence into automobiles are driving up the demand for semiconductors in this segment and account for approximately 14% of the entire semiconductor market.

“NVIDIA’s rapid growth in semiconductor revenue has placed them as the second largest semiconductor company by revenue in 2023, trailing Intel. Samsung, the industry leader in 2022, slipped to third place in 2023 as their memory revenue declined by nearly half from the 2021 level,” added Leimbach.

The downturn has notably affected major memory makers, traditionally among the top semiconductor companies by revenue. Previously, from 2017 to 2021, Samsung, SK Hynix, and Micron were all ranked in the top five companies by revenue. However, amidst the challenging memory market conditions, Samsung is now ranked third, SK Hynix is ranked sixth, and Micron is ranked twelfth in 2023.

The leader in the total 2023 revenue was Intel. The US chipmaker sold $51.20 billion worth of semiconductors. However, compared with 2022, Intel's revenue dropped 15.8%. With 133.6% growth, NVIDIA jumped to second place with a total revenue of $49.16 billion. Samsung dropped to the third spot, ahead of Qualcomm, Broadcom, SK Hynix, AMD, Apple, Infineon, and STMicroelectronics.