Business Users and Developers Are the Main Opportunities for AI PCs

AI is coming to the PC, but Apple and NVIDIA already have a lock on creative and gaming users, says a new Omdia report.

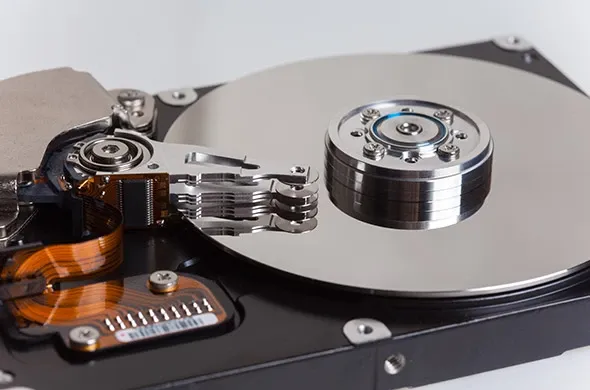

Total EMEA external storage systems revenue fell by 3.9% in the first quarter of 2017, according to the IDC Quarterly Disk Storage Systems Tracker 1Q17. The all-flash market outpaced expectations and grew 100.7% with accelerated growth in Western Europe and in the Middle East and Africa. In contrast, the traditional hard disk array (HDD) segment in EMEA fell 34.5% in 1Q17.

"Brexit uncertainty, unfavorable exchange rates, major vendors' internal reorganizations, and increased component costs for SSD have weighed down on EMEA performance once again, making 1Q17 the ninth quarter of uninterrupted decline for the region," said Silvia Cosso, research manager, European Storage and Datacenter Research, IDC. "However, as enterprises progress in their digital transformation paths, sales of all-flash array systems, standalone or converged, see no crisis in sight, doubling their sales compared to the same period a year ago and reaching a quarter of total sales.

The Western European external storage market was lackluster with a fall of 0.8% YoY in the first quarter of 2017, accounting for $1.22 billion in market value. In euro terms, however, it was a positive picture with the Western European ESS market growing 2.7% YoY in value in 1Q. The capacity in the region grew 6.7% to 2,350.4 petabytes. All-flash array (AFA) storage solutions registered 107.1% YoY growth in the quarter, lifting the overall external storage market. Flash storage systems (AFA and HFA) together now account for almost three-quarters (70.3%) of the total market value in the region.

The Central and Eastern Europe, Middle East, and Africa (CEMA) external storage market declined 14% to reach $340.8 million in value. Capacity also slipped, the result of only a marginal reduction of $/GB. The strong negative impact was due to the Russian market's performance, and excluding it would see the CEMA region decline by only a low single-digit rate. The AFA segment posted another successful quarter with nearly 80% YoY growth and 23% of the total value.

Looking at the subregional level, Central and Eastern Europe (CEE) underperformed the Middle East and Africa (MEA). Storage investments in most CEE EU member states intensified, boosted by the launch of new flash-optimized midrange solutions and the realization of high-end storage projects by the government, finance, and manufacturing sectors. However, the Russian storage market dragged the entire region down due to the postponement of already approved projects for next quarter by public and large corporate clients.

The MEA storage market showed a more diverging trend than in previous quarters and was able to limit its decline to single digits, mostly supported by SMB activity. However, spending behavior differed by country. Most smaller markets significantly increased their investments in midrange and high-end hybrid storage, while the largest markets (South Africa, Turkey, Israel, and Saudi Arabia) more than doubled their investments in AFA solutions.

Top 5 Vendors, EMEA External Disk Storage Systems Value ($M) | |||||

Vendor | 1Q16 | 1Q16 Market Shares | 1Q17 | 1Q17 Market Shares | 1Q17 YoY Growth |

Dell | $518.4 | 31.8% | $409.5 | 26.1% | -21.0% |

NetApp | $258.7 | 15.9% | $282.4 | 18.0% | 9.2% |

HPE | $237.6 | 14.6% | $228.9 | 14.6% | -3.7% |

IBM | $143.6 | 8.8% | $166.9 | 10.6% | 16.2% |

Hitachi | $134.0 | 8.2% | $146.6 | 9.4% | 9.4% |

Others | $338.3 | 20.7% | $333.1 | 21.3% | -1.6% |

Grand total | $1,630.8 | 100.0% | $1,567.5 | 100.0% | -3.9% |