Worldwide IT Spending to Grow Eight Percent in 2024

Worldwide IT spending is expected to total $5.06 trillion in 2024, an increase of 8% from 2023, according to the latest forecast by Gartner.

Total EMEA external storage systems value increased by 11.7% in dollars in the fourth quarter of 2017 (+2.4% in euros), according to IDC.

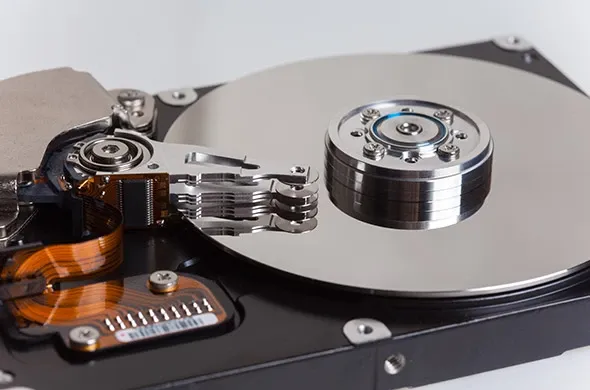

The all-flash-array (AFA) market value recorded high-double-digit growth in dollars (35.8%), accounting for almost 31% of overall external storage sales in the region, albeit with a marginally slower growth rate as it becomes increasingly sizeable. Hybrid arrays also grew (19.5%), but their share of total external sales remained stable compared with the previous quarter. HDD-only systems continued to contract (-18.9%).

With total AFA shipments now firmly at a third of the market in terms of value (33.3%), the Western European external storage market recorded sound growth of 9.8% in dollar terms (+0.7% in euros). Capacity, meanwhile, grew 8.7% to 3,043 petabytes.

The German market remained particularly strong, more than offsetting a still weak U.K. market which has been hit by an uncertain macroeconomic situation that has halted investments. But structural challenges remain in the subregion, as new infrastructure consumption models brought about by public cloud become mainstream and hardware commoditization accelerates in the region.

The external storage market in CEMA reached another milestone over the past five years, posting a YoY value increase of 17.0% ($566.2 million) and a capacity increase of 16.9% (1.1 petabytes). The high-end segment, which was particularly strong across the wider EMEA area, flourished in CEMA too, increasing its share by nearly 5% with 50% YoY growth.

IT departments in the bigger CEMA countries and smaller Central and Eastern Europe (CEE) markets continued with DC infrastructure refreshments and optimization, while run-rate business also intensified. Supported by special vendor programs, the deals featuring flash storage upgrades for customers reaching a certain capacity threshold contributed to the double-digit growth in both CEE and the Middle East and Africa (MEA). AFAs continued to thrive (50.4%) but hybrid flash arrays (HFAs) also accounted for a sizeable portion of storage investments (30% YoY growth), reclaiming 50% of the total market value.

Top 5 Vendors, EMEA External Disk Storage Systems Value ($M) | |||||

Vendor | 4Q16 | 4Q16 Market Shares | 4Q17 | 4Q17 Market Shares | 4Q17 YoY Growth |

Dell EMC | $572.16 | 30.59% | $523.61 | 25.07% | -8.49% |

HPE | $323.96 | 17.32% | $348.21 | 16.67% | 7.49% |

IBM | $219.72 | 11.75% | $310.86 | 14.88% | 41.48% |

NetApp | $252.65 | 13.51% | $289.43 | 13.86% | 14.56% |

Huawei | $67.16 | 3.59% | $159.79 | 7.65% | 137.94% |

Others | $434.47 | 23.23% | $456.74 | 21.87% | 5.13% |

Grand total | $1,870.12 | 100.00% | $2,088.64 | 100.00% | 11.68% |