Smartphone Market Starts 2024 With 11 Percent Growth in Q1

According to Canalys’ latest research, worldwide smartphone shipments grew 11% year on year in the first quarter of 2024.

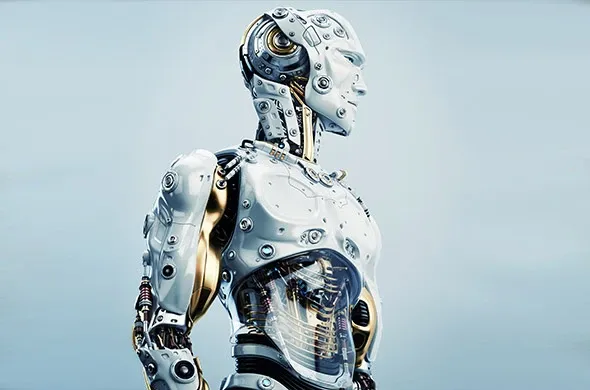

According to IDC, worldwide purchases of robotics, including drones and robotics-related hardware, software and services, will total $97.2 billion in 2017, an increase of 17.9% over 2016. IDC expects robotics spending to accelerate over the five-year forecast period, reaching $230.7 billion in 2021 with a compound annual growth rate (CAGR) of 22.8%.

The Discrete Manufacturing and Process Manufacturing industries will continue to be the largest purchasers of robotics products and services with 2017 spending totals of $30.5 billion and $24.1 billion, respectively. Combined, these two industries will account for more than half of all robotics spending throughout the forecast.

The Resource industries, which include mining, oil & gas extraction, and agriculture, will be the third largest robotics market in 2017 with global spending of nearly $9.0 billion. The industries that will see the fastest spending growth over the 2016-2021 forecast period are Education (71.9% CAGR), Retail (51.3% CAGR), Construction (38.3% CAGR), Wholesale (37.2% CAGR), and Insurance (36.3% CAGR).

The primary use case in the Process Manufacturing industry (mixing) will capture more than 15% of all robotics spending. Other robotics use cases that will drive spending include automated production, mining and pick and pack (Wholesale). The use cases that will see the fastest growth in robotics spending over the forecast period include break bulk (71.6% CAGR), educational assistance (68.3% CAGR), and delivery to customer (60.6% CAGR).

More than half of all robotics spending this year ($50.7 billion) and throughout the forecast will go to robotics systems, after-market robotics hardware, and systems hardware. Services-related spending will total more than $24 billion in 2017 while spending on command and control, specific robotics applications, and network infrastructure software will reach $15.2 billion. Purchases of drones and after-market drone hardware will be nearly $7.0 billion this year and represent the two fastest growing categories of robotics spending throughout the forecast, followed by education and training.

On a geographic basis, the Asia/Pacific region (excluding Japan)(APeJ) will account for more than half of all robotics spending in 2017 ($51.5 billion) and throughout the forecast. Japan will be the second-largest region in 2017 ($14.3 billion), followed by the United States and Western Europe ($13.6 billion and $10.1 billion, respectively).

By the end of the forecast, however, the United States is forecast to move into the second position. All four regions will be led by strong robotics spending by the discrete and process manufacturing industries. The regions that will see the fastest growth over the five-year forecast are Latin America (26.5% CAGR), APeJ (25.2% CAGR), and the United States (24.1% CAGR).