Larry Ellison Offers Personal Guarantee to Paramount's Warner Bid

The co-founder of Oracle, Larry Ellison, announced that he would issue personal guarantees on behalf of Paramount Skydance in an effort to acquire Warner Bros. Discovery.

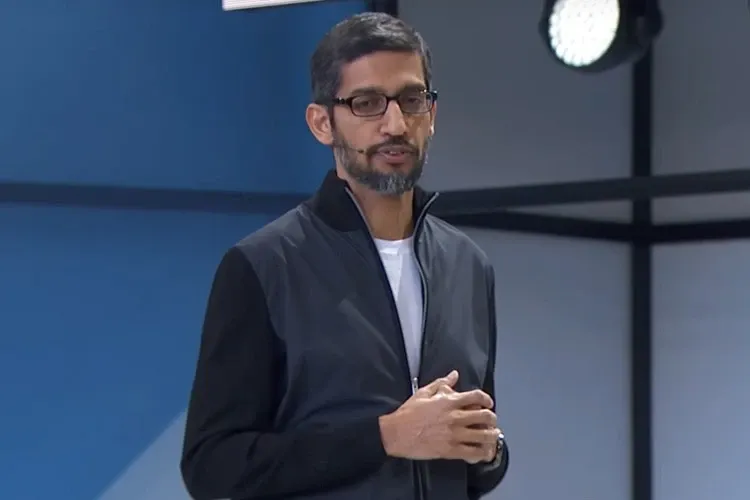

Google CEO Sundar Pichai is about to have a very big week, according to Bloomberg.

An award of 353,939 restricted shares he received before a promotion in 2014 will vest this week. At the end of last week, the grant was worth about $380 million, making it one of the largest single payouts to a public company executive in recent years.

Pichai, 45, who has led Google since 2015, received the shares before his promotion to senior vice president of products a year earlier, when he took over many of co-founder Larry Page’s responsibilities. The award swelled in value as Alphabet’s stock surged 90 percent since the grant date. He has received two more nine-figure stock grants since then. The company has yet to disclose Pichai’s compensation for 2017.

In 2016, CEOs of S&P 500 companies realized an average of $16.2 million from shares that vested or exercising stock options. Other tech executives have received hefty payouts in the past. Facebook’s Mark Zuckerberg reaped $2.28 billion when he exercised 60 million options as part of the company’s initial public offering in August 2012. Months later, restricted shares worth $822 million held by his deputy Sheryl Sandberg fully vested.

In 2016, Tesla’s Elon Musk collected $1.34 billion after exercising 6.71 million options that were close to expiring, in part to cover a $593 million tax bill. That same year, Monster Beverage’s two top executives took in a combined $598 million thanks to the stock rising an average of 30 percent a year for a decade.