Customers want quick and cozy digital experience, and they want it now. They want to log in to their online accounts and see consumption reports of services they use, expect to see desired applications on their mobile phones as soon as they open the box, or online bank loan approval within a few minutes. These days, customers really want more, but there is no magic formula for meeting their needs. Importance of personalized offers is rising, so you really need to know your customers. Not to know them good, you need to know them exceptionally good.

Market need for solutions like Husky

Finance institutions across the globe are realizing that (Big) Data means Big Business. Developing and implementing successful Big Data strategies is now imperative for all financial institutions as they look to retain and increase their market share and drive revenues.

Information is everything. Having the right information at the right time can make a difference when it comes to business growth. "The key to business growth through sales enhancement is related to knowing your customer, its habits and needs. If you know your customer and his needs, then it will be much easier to provide him with an offer which he is more likely to accept. Higher conversion rates obviously lead to additional revenue and business growth, so this is a target for everyone, year by year", according to Mario Marić, business development manager, COMBIS.

Having that in mind, a system which would provide relevant information on how to reach customers with targeted, personalized offers, would surely improve conversion rates on the offers sent to customers. Understanding customer habits, their activities, and consequently their needs helps in understanding the best way to reach them and with which offer, enabling highest possible chance of conversion.

As an answer to these companies' needs COMBIS developed Big Data solution Husky. Husky is a platform used to monetize data that already exists within finance institutions.

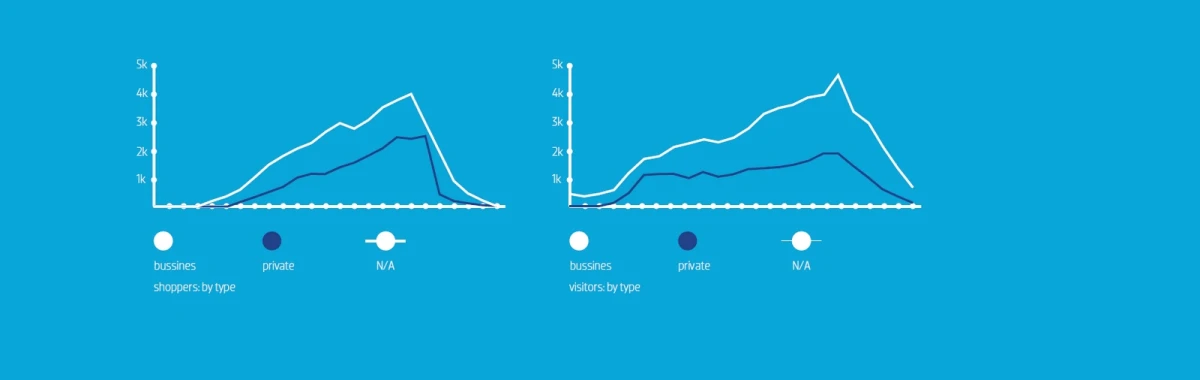

Click on image to enlarge

The approach applied in the data monetization process consists of two general streams - internal and external monetization. Internal monetization can be achieved by smart optimization of internal resources after monitoring clients’ behavior, technology and services they use. In other words, optimizing business by using data for in-house analytics and more informed decision-making and for enhanced sales and marketing activities, preferably in real time. External monetization, on the other hand, is focused towards external clients by providing them with relevant data they can use to improve their business.

Importance of real time data processing

On top of the exact information on customer activities and their needs, there is a few more information that could be even more relevant. One of those is location of a particular action, and the second one is time when action occurred - preferably in real time. Reasons why this is so relevant are obvious: if you know where your customer is, you can understand his/hers habits and needs much easier; and the same principle applies for the time as well, as information now is much more valuable then information 2 days from now.

With system which detects a customer need, on the customer’s location in real time, you get the best out of available information for a particular customer. That being said, such a system enables highest possible chance of offer conversion, as an obvious example of sales enhancement.

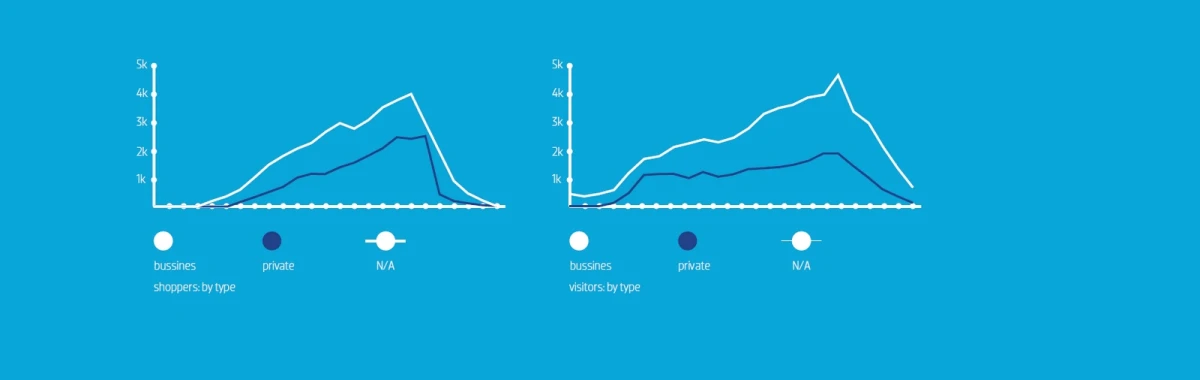

Click image to enlarge

Presentation of these information is very simple - in forms of heat-maps, dashboards and reports. Moreover, it is possible to monitor 'migrations' of potential customers in different time zones - daily, weekly or monthly.

In Erste bank COMBIS implemented the real time transaction data processing system which enables Bank to react to client’s actions in real time thus giving the opportunity to communicate tailor made offer for each client. This means that the Bank can recognize specific client’s need at that moment and send an advice or a campaign at the same moment which leads directly to providing additional value for the client.

Clients responded very positively on this approach by increasing the response rates on offers with total absence of any client complaints producing an increase of sales volumes.

Based on current results we are confident that using the approach of reacting at the right time with the relevant offer will increase productivity of our sales network as well as client loyalty. Both factors will lead to higher profitability.

Dean Muhoberac, Deputy Director of CRM and Analysis Department at Erste Bank Croatia

HUSKY TEAM IN FRANCE

If you want to know more about this solution, Husky team - Andrej Anđelić, senior sales expert and Mario Marić, business development manager - will be on Trustech conference - the largest global event dedicated to IT solutions for payment, identification and mobility! Trustech will be held in Cannes from 29.11. - 1.12.

Find COMBIS Husky team at Marina C 114 stand and come and see COMBIS keynote - Mario Marić who participates in panel discussion 'Question the Thought Leaders: Delivering New Service Opportunities in a World of Big Data' on November 29th, at 2 pm.

About COMBIS

COMBIS, a member of Deutsche Telekom Group is a system integrator with over 25 years of practice and more than a thousand projects carried out in both local and foreign markets.