Business Users and Developers Are the Main Opportunities for AI PCs

AI is coming to the PC, but Apple and NVIDIA already have a lock on creative and gaming users, says a new Omdia report.

Shared mobility and automation are expected to drive a revolution in the automotive industry workforce and production by 2030, according to a new study by PwC’s Strategy& consultancy.

The study predicts substantial changes for manufacturers and consumers. Vehicle production will have split between mass-market, largely no-frills “cars on demand“ that will be rented journey-by-journey and more customized vehicles for those who still want to drive, or be driven in, their own vehicle.

PwC expects that this will require original equipment manufacturers (OEMs) to rapidly develop two distinct types of factory. The first will be focused on standardised, networked ‘plug and play’ vehicles aimed at young, urban drivers. The second ‘flex champion’ model will produce customised vehicles for a range of consumers, akin to today’s luxury prestige market.

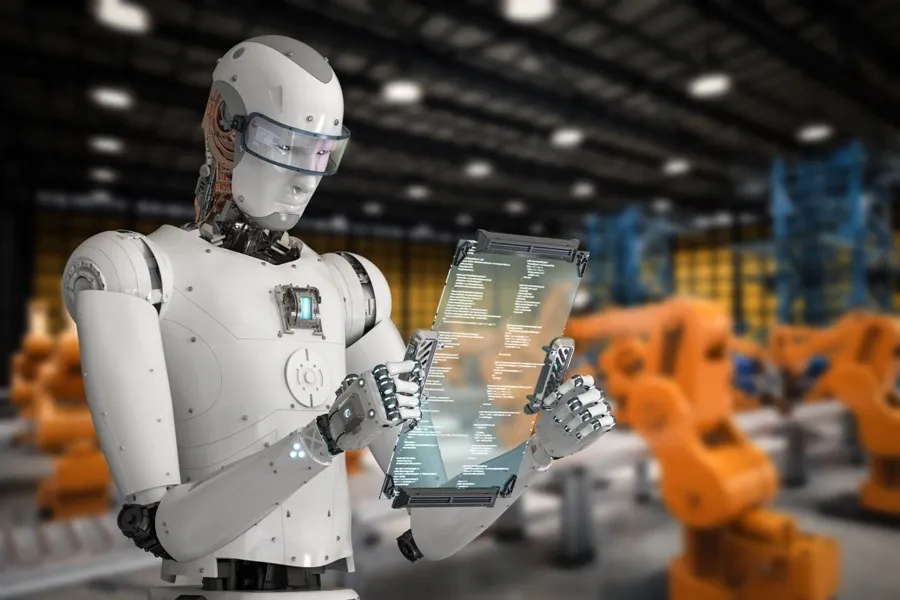

The study expects this change to radically alter the current workforce as robots take on a greater share of the work, on both assembly lines and in the R&D function. It is estimated that between 40-60% of today’s workers with contemporary skills will be needed on the shop floor, although the required number of data engineers and software engineers may rise by 90%.

“The auto industry has not substantially altered its model since Ford’s assembly lines were introduced over a century ago,“ says Heiko Weber, partner in PwC Strategy& Germany. “Yet we expect to see many of these changes to gather pace by 2021. OEMs must start now to build the workforce they will need over the next decade, both by hiring people with the right skills and by retaining and retraining their existing employees. By 2030 the number of data engineers will almost double in the flexible plant and increase by 80 percent in the plug-and-play plant, while the number of software engineers needed will rise by 90 percent, and 75 percent, respectively,“ Weber says.

The study also notes that the pace of change will accelerate in other areas, with the time between R&D and production to shrink to two years, compared to 3-5 years today. There will also be growing competition to OEMs from technology companies who will be able to provide mobility-as-service solutions directly to consumers. At the same time, there will be growing pressure on manufacturers to create far more cost-efficient production processes to accommodate an increasingly diverse range of vehicles and designs.