AML Adoption to Hit 3.8 Million Businesses by 2030

A new study from Juniper Research found that the number of businesses deploying Anti-money Laundering (AML) systems will surge to more than 3.8 million worldwide by 2030.

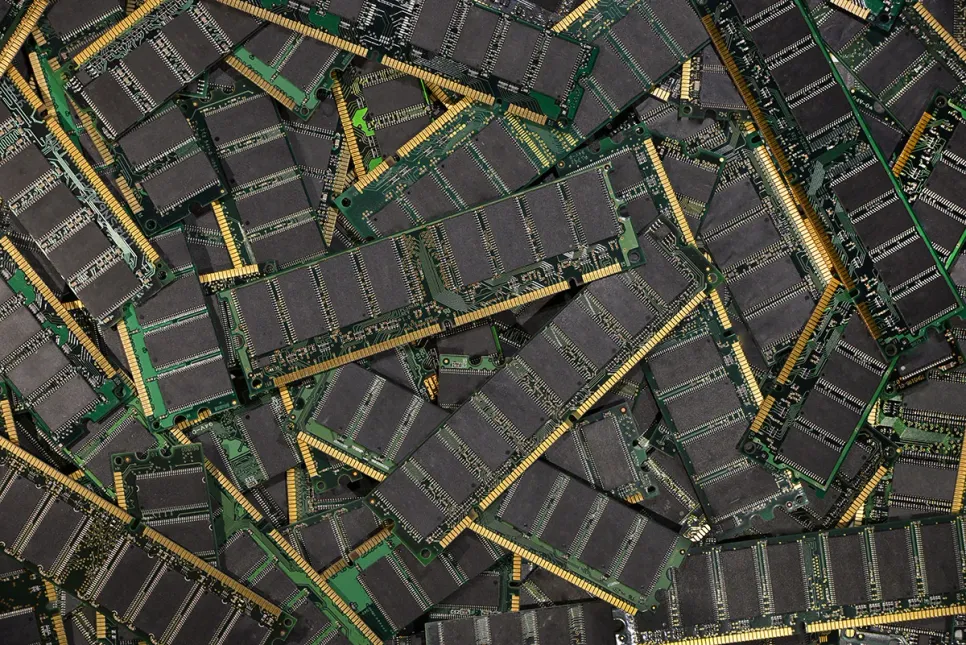

Global NAND flash revenues increased 4.6% in the first quarter of 2021 to $15.3 billion over the previous quarter, according to Counterpoint Research. Distance education and remote working propelled the demand for notebook SSDs, which helped the big players in offsetting the reduced NAND flash demand from the server and data center market.

Associate Director Brady Wang said the continued expansion of smartphone storage capacities, particularly by the Chinese OEMs, created an unusual scenario for NAND flash usage. The average capacity of smartphones climbed 6% in Q1 2020, according to Counterpoint data. As a result, contract prices for NAND flash fell by 4-7% in Q1 2021, which is much lower than the 7-11% drop in Q4 2020. The decrease eased in late Q1 2021. In the same period, NAND flash spot prices fell 1-3% but started increasing by that quarter’s end.

Wang added that in Q1, memory vendors were in full force migrating to more layers. Bit shipment increased 12% QoQ, while overall ASP decreased 6% in the same period. In terms of layers, the ratio of bit shipment for the layers 64 to 130 increased from 52% in 1Q20 to 81% in 1Q21. This increase in layer count allowed an annual reduction in NAND costs by an average of 20%, which however is less than the historical 30%. Ideally, NAND flash can reach more than 500 layers. However, in reality, the NAND flash production starts encountering several challenges after 100 layers, like a high aspect ratio and long manufacturing time. As a result, vendors adopt Core Over Periphery (COP)/Circuit Under Array (CUA) to reposition the logic circuit to below the memory cell. Doing so allows them to increase the number of net per wafer. Also, double stacking can help increase the number of layers quickly but may result in higher costs due to lower yields.

On the handset side, key NAND flash players are proactively marketing the high-density uMCPs at advantageous costs. Chinese smartphone MCP densities rose from 8GB/128GB to 12GB/256GB over the previous quarter. Currently, the NAND flash industry is dominated by six major players. This landscape is likely to undergo a major rejig in the near term, given the ongoing acquisition of Intel’s non-volatile memory solution unit by SK hynix.

Samsung led the NAND market in Q1 2021 with $5.1 billion in revenues, overshadowing its nearest competitor by over 80%. SK hynix’s revenues from NAND achieved a good 12% QoQ growth in Q1 2021 despite enduring a 7% drop in its ASP. Ranking third in revenue, WDC’s portfolio in laptop SSDs helped it benefit from the surge in PC demand, resulting in an 8% increase in its QoQ bit shipments in this quarter. The company experienced a revenue growth of 10% and 8% respectively, balancing its 20% revenue decline in the data center market.