D2C Revenue Set for $370 Million Surge

A new study by Juniper Research has found that satellite provider revenue from direct-to-cell (D2C) will exceed $370 million in 2026, up from $100 million this year.

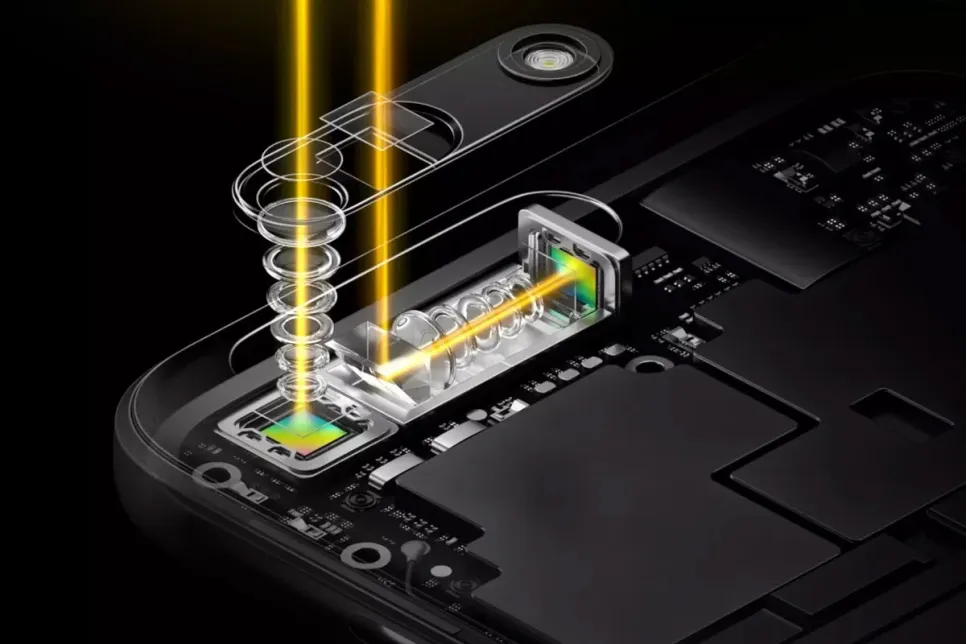

As ongoing supply chain shortages continue to impact the industry, Omdia’s latest research found that shipments of triple camera smartphones increased to the same level as quad-camera smartphones in the third quarter of 2021. The share of smartphones employing a single camera in global shipments fell to 8% in Q3 this year, a decline of six percentage points from 14% a year ago.

“The adoption of the multi-camera lenses continues to expand even in low-cost smartphones under $150,“ said Jusy Hong, senior research manager for mobile devices at Omdia. Due to several external factors, over the second quarter of 2021, quad-camera share has decreased, with the triple cameras occupying the largest share, according to data from Omdia's Smartphone Model Market Tracker. At the same time the share of dual cameras, which had been decreasing in 2021, is also rebounding.

“This trend reversal is taking place due to OEMs reducing the number of lenses to decrease camera-related costs brought on by the continued shortage of major semiconductor components. Low-end smartphones use a combination of low-resolution lenses, as marketing a large number of lenses be more important than offering camera functions and image quality improvements. At this point, OEMs are bucking the trend of reducing the number of cameras in mid-end models from quad to triple," added Hong.

Conversely, the use of high-resolution camera lenses is steadily increasing. OEMs are adopting high-resolution lenses to improve image quality instead of adding lenses with questionable functionality. The most utilized resolution in the third quarter was 48MPX, accounting for 25% of total shipments. This is an increase of one percentage point from the same period of the previous year. On the other hand, the share of 13MPX resolution lenses, which accounted for 28% in the third quarter of 2020, decreased to 22% this year. Meanwhile, the shares of 64MPX and 108MPX were 19% and 5%, respectively, which is an increase of 7% and 3% points compared to last year.

In addition to component pricing pressures, advancements in AI and computational photography enable OEMs to pick and choose their preferred camera set-ups according to the targeted price segment and feature set. Where before a certain type of lens was necessary to enable a feature, in some cases the extra lens can be removed because the camera software can achieve the same result providing a new level of flexibility to OEMs.

“To meet high consumer expectations for smartphone camera performance, we can see the trend is changing to competition for performance improvements rather than competition for the number of lenses. Especially in the mid-end segment, the race towards the highest possible number of lenses appears to be over,“ concludes Hong.