Server Market Revenue Increased 61 Percent in 3Q25

The server market reached a record $112.4 billion in revenue during the third quarter of the year, according to IDC.

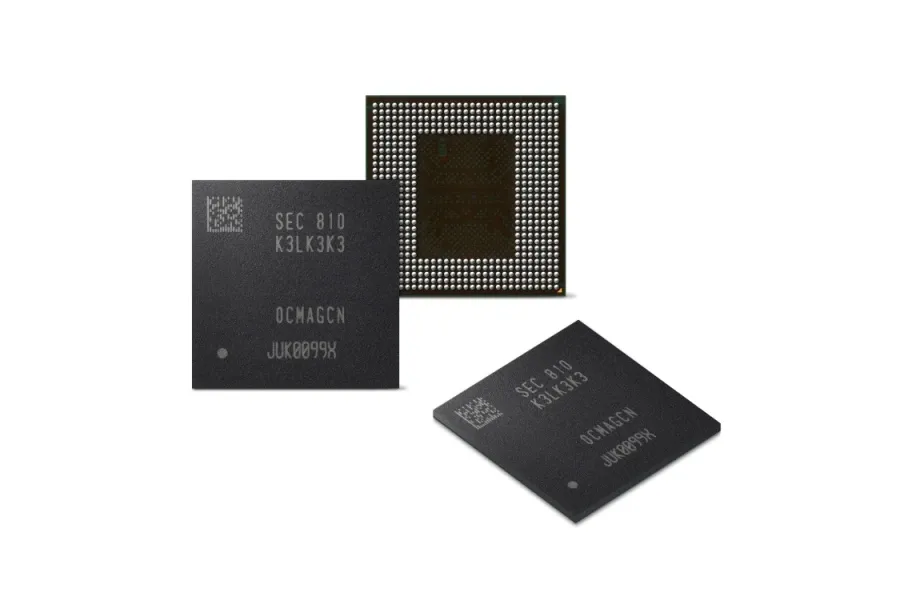

The global market for smartphone memory chips reached a combined value of $39.3 billion in 2019, according to the Strategy Analytics. Samsung maintained its smartphone memory market share leadership with 47 percent revenue share in 2019, followed by SK Hynix and Micron. Samsung continued to strengthen its position in both NAND Flash and DRAM markets. The top-three vendors captured almost 84 percent revenue share in the global smartphone memory market in 2019.

The total NAND Flash revenue for smartphones witnessed a decline of 29 percent year-over-year owing to the slowdown in the market demand. The market was dominated by Samsung with a revenue share of 42 percent followed by Kioxia and SK Hynix, each having a share of 22 percent and 16 percent respectively in the smartphone NAND flash market in 2019. The overall DRAM market revenue for smartphones recorded a decline of 27 percent year-over-year due to the fall in demand and pricing challenges. In terms of vendor share, Samsung registered a revenue share of 51 percent followed by SK Hynix with 29 percent and Micron with 19 percent share.

“In 2019, the memory market observed a decline in revenue owing to seasonality and existing oversupply in the market that lead to a fall in memory chip prices. Samsung registered successful design wins with major smartphone OEMs for its NAND Flash and DRAM memory chips in CY 2019 which drove its revenue. The increase in the demand for eMMC and UFS based Multichip Packages contributed in the chip shipments for Samsung Memory and SK Hynix in CY 2019,“ said Jeffrey Mathews, analyst at Strategy Analytics.

“The smartphone memory market is expected to witness a slowdown in memory demand ahead, owing to the disruptions in global smartphone production and waning demand in end-product markets due to COVID-19 pandemic. We also note that the memory vendors would soon enable their portfolio to leverage the growing demand for new memory technologies such as UFS 3.0 and LPDDR5 among smartphone OEMs,“ according to Stephen Entwistle, VP of Strategic Technologies Practice at Strategy Analytics.