Orange and Ericsson Deploy 5G Network for Madrid Public Safety

In a collaboration for the Madrid Council, Orange and Ericsson are equipping the city’s public and emergency services with advanced connectivity.

With 3GPP technologies able to meet increasing industry requirements on performance, the demand for private cellular networks is growing rapidly. According to Arthur D Little’s predictions, the market for private campus networks, services and solutions are expected to be worth EUR 60-70 billion by 2025.

Ericsson has partnered with a broad range of service providers to connect industries and enterprises whose businesses are rapidly digitalizing. In the first half of 2019, the company has entered agreements with Telefónica, Telia, Telstra, Vodafone, Deutsche Telecom, and Elisa to provide its Private Networks solutions.

“Industries benefit from the technical expertise and 5G evolution plans that service providers bring to their business. They can also rely on existing service provider investments to extend their operations to new, unexplored use cases. By doing so, they can focus on innovating and optimizing their core business, leaving the complexity and evolution of connectivity services in the capable hands of their service provider,“ says Manuel Ruiz, Head of Mission Critical & Private Networks, Ericsson.

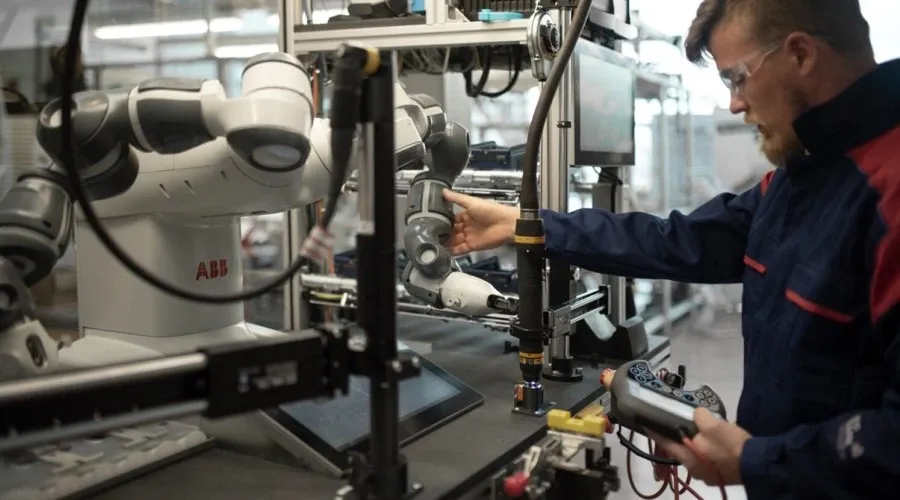

About 20km from its headquarters in Stuttgart, Germany, Mercedes-Benz is building a new, 220,000sq m production facility. At Factory 56, all production systems and machines will be connected and operated via secure 5G that will achieve real-time low latency performance while handling enormous amounts of data. The 5G network, built by Ericsson and Telefónica Germany, will help Mercedes-Benz to boost the flexibility, precision and efficiency of its production operation.

Regulators have been releasing more and more spectrum to traditional mobile network operators as well as specialist service providers, and in some countries even directly to local industries and enterprises. These moves have all helped to accelerate the growth and deployment of private networks.

Private networks can use licensed, unlicensed and, in some countries, shared spectrum in the 3.5-4.2GHz and 5GHz bands. In licensed spectrum, many countries have defined specific frequency ranges for public safety and/or utilities. Flexible in meeting varied market demands, Ericsson has been working with the utilities sector, for instance, to explore functionalities for critical communications such as eMBMS, enabling broadcast services for efficient group communications to large numbers of users simultaneously.