Global EV Transition at Crossroads

The global electric vehicles market is entering a phase of divergence, fragmenting the global electrification transition, according to Counterpoint Research.

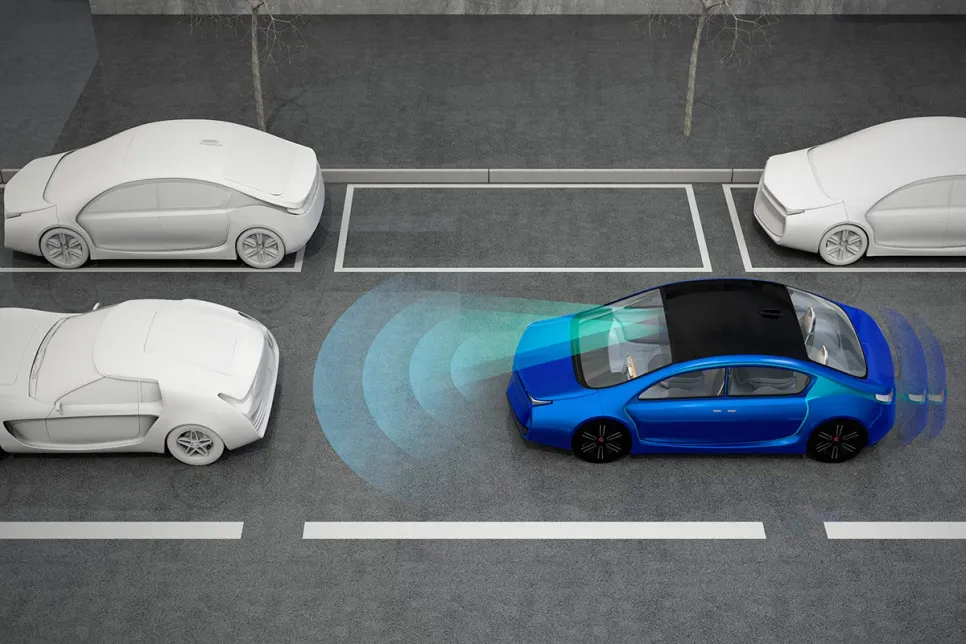

The global market for autonomous vehicle sensors, including cameras, radar, imaging radar, and LiDAR, is expected to grow at a strong pace through 2035, according to Counterpoint Research. This growth will be driven by tightening vehicle safety regulations, rapid advances in sensor and semiconductor technologies, and the rising adoption of Level 2+ systems (hands-free driving for highway and/or assisted driving in dense urban areas), as well as fully autonomous vehicles at SAE Levels 3 and 4.

The global market for Advanced Driver Assistance Systems (ADAS) and autonomous driving (AD) sensors is expected to reach $61 billion by 2035. Camera sensors are expected to remain the largest segment by volume, while growing to a $20-billion market size by 2035, supported by widespread deployment in braking, lane-keeping, and driver monitoring systems. However, LiDAR and imaging radar are projected to remain among the fastest-growing segments by value, with an expected combined market size of $28 billion by 2035, as automakers pursue higher-resolution perception and redundancy for advanced automated driving functions.

“Autonomous vehicle sensor architectures are becoming increasingly complex, with OEMs moving decisively toward multi-sensor fusion. Also, imaging radar and solid-state LiDAR are fast reaching the cost and reliability thresholds required for mass production,” said Mohit Sharma, Senior Analyst at Counterpoint Research.

The forecast highlights 4D imaging radar as a key growth technology, offering improved angular resolution and object classification compared with traditional radar, while maintaining robust performance in poor visibility conditions. Solid-state LiDAR adoption is also accelerating, supported by fast-declining component costs from Chinese manufacturers such as Huawei, Hesai, and RoboSense, along with improved integration into centralized vehicle computing platforms.

In terms of volume, China leads the global adoption of ADAS and AD sensors, including cameras, radars, and LiDARs, driven by higher penetration of Level 2+ vehicles and an expected future increase in fully autonomous vehicles at Levels 3 and 4. Europe and North America are also key markets, with a stronger focus on safety and autonomous driving regulations, and are expected to be at the forefront of camera, imaging radar, and LiDAR deployments.

The growing convergence of sensors, perception software, and centralized vehicle computing is also an important factor automakers are considering when evaluating sensor partners, as they accelerate their transition toward software-defined vehicle (SDV) architectures to support advanced automation and over-the-air feature upgrades.

“Sensor innovation is closely tied to the rise of SDVs and centralized compute architectures. Suppliers that can align hardware performance with perception software, functional safety, and scalable manufacturing will be best positioned to capture value as vehicle autonomy advances,” said Murtuza Ali, Senior Analyst at Counterpoint Research.

The expanding autonomous vehicle market presents significant growth opportunities for sensor suppliers, while OEMs are expected to evaluate multi-source strategies to optimize costs. Suppliers that secure early design wins and support scalable manufacturing will benefit as autonomous vehicles move toward the mass-market phase over the next decade.