Meta Plans to Double the Production of Ray-Ban AI Glasses

Meta Platforms and EssilorLuxottica discussed doubling the production of AI Ray-Ban smart glasses by the end of the year.

Seagate surged the most in almost nine months after reporting earnings that beat analysts’ estimates and telling investors it expects to have access to new technology that’s eating into its main business, according to Bloomberg.

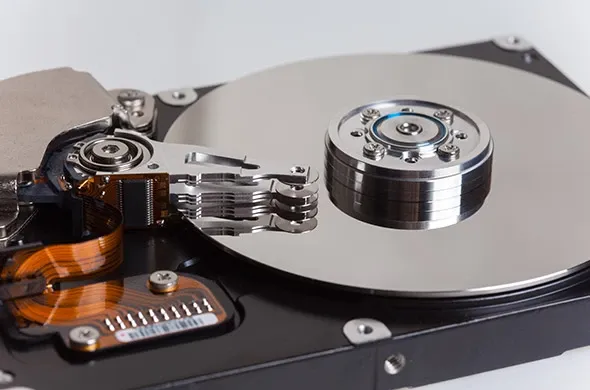

The company, the largest maker of computer drives, said earnings per share were 96 cents in the fiscal first quarter ended Sept. 29, surpassing analysts’ average projections for 86 cents. Revenue was $2.63 billion in the period, also better than expected. The shares jumped as much as 17 percent.

Hard disk drive makers are benefiting from strong demand from data center owners who are struggling to keep up with the need for storage created by the flood of data from online services. Such demand is helping the industry stave off declining demand from the PC market, where storage based on semiconductors is taking over.

The report was a stark turnaround from the previous quarter, when the company said it was replacing its longtime CEO Steve Luczo and was shedding 600 jobs. Dave Mosley became the new CEO. He told investors and analysts on a conference call that he expects to secure a long-term agreement with Toshiba’s memory chip unit to provide it with the NAND flash for new drives.

At the end of September, Seagate said it would be part of a consortium that has agreed to acquire Toshiba’s memory chip business. The investment in the group, which includes Apple, Dell and others, may secure Seagate cheaper access to the chips. It may also disrupt the company’s rival Western Digital, which failed in a bid to acquire the Toshiba unit and may lose access to supply from its Japanese partner.