2026 to Witness Unprecedented Buildout in the Data Center Space

In 2025, talk of the AI bubble grew stronger, with frontier projects such as Stargate dominating the headlines, according to GlobalData.

Worldwide spending on robotics and related services will more than double by 2020, growing from $91.5 billion in 2016 to more than $188 billion in 2020, according to the newly updated Worldwide Commercial Robotics Spending Guide from IDC. In addition to spending data on robotic systems, system hardware, software, robotics-related services, and after-market robotics hardware, the robotics spending guide now includes data on commercial purchase of drones and after-market drone hardware.

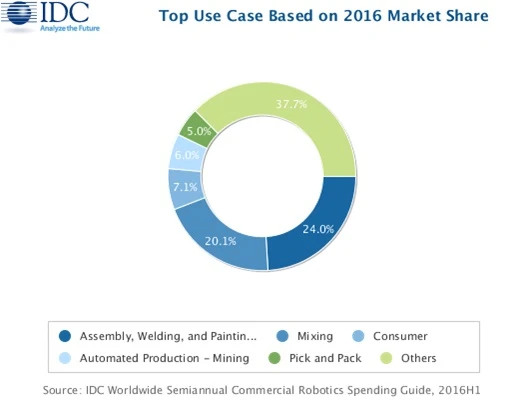

More than half of all robotics spending comes from the manufacturing with Discrete Manufacturing delivering 31% and Process Manufacturing providing 28% of the worldwide total in 2016. This situation will remain relatively unchanged throughout the forecast with the two industries investing nearly $110 million in robotics in 2020. The leading robotics use case in Discrete Manufacturing is assembly, welding and painting, while mixing is the leading use case in Process Manufacturing.

After manufacturing, the three industries with the largest robotics spending in 2016 were Resource Industries ($8.0 billion), Consumer ($6.5 billion), and Healthcare ($4.5 billion). These industries will maintain their relative positions throughout the forecast, although Consumer spending will significantly narrow the gap with Resource Industries by 2020. Cross Industry robotics spending, which represents use cases common to all industries, such as warehouse pick and pack, will also rank among the top segments throughout the five-year forecast. The industries that will experience the fastest growth over the 2015-2020 forecast period are Consumer, Healthcare, and Retail.

From a technology perspective, purchases of robotics systems, which includes consumer, industrial, and service robots, and after-market robotic hardware will total more than $40 billion in 2016. Services-related spending, which encompasses applications management, education & training, hardware deployment, systems integration, and consulting, will come to more than $20 billion in 2016. The fastest growing segments of robotics spending are drones and after-market drone hardware, which will grow to nearly $20 billion in 2020.

On a geographic basis, the Asia/Pacific region, including Japan, will account for more than two thirds of total robotics spending throughout the forecast. Europe, the Middle East, and Africa (EMEA) is the second largest region with expenditures of $14.7 billion in 2016, followed by the Americas with a 2016 spending total of $12.9 billion. Robotics spending will more than double in Asia/Pacific over the 2015-2020 forecast period, making it the fastest growing region followed by the Americas, which will edge ahead of EMEA in total spending by 2018.